The Omnichannel Banking Trends in 2023

Omnichannel Banking Trends provides users with easier access to their data and ensures transparency and security in the services they choose to utilise.

Before going on Omnichannel Banking Trends, we will discuss what is omnichannel Banking.

What exactly is Omnichannel Banking?

From the perspective of the customer in interactions with customer service, there is nothing more anger than the feeling of being transferred between agents, or from platform to platform and having to explain your problem over and over repeatedly.

We live in the period with Amazon delivery drones, facial recognition technology, and even facial identification software, wouldn’t we?

Do organizations have their customer relationship management (CRM) channels coordinated?

The good thing is that they are able to however, it requires the appropriate technological infrastructure. In the realm of retail banking, this would mean the implementation of a CRM system.

All touchpoints connect and share data, ensuring that customers of banks and credit union members or employees — will never need to search to find their information. This is called omnichannel banking.

Omnichannel infrastructure gives users access to, real-time information across every touchpoint. The growing trend in retail banking is in line with the plan because consumers are no longer looking for unidirectional, compartmentalized experiences.

They want to connect with brands and services anywhere they are, anytime, and anyway, they would prefer, leaving off, and resuming the conversation when they need to on the platform of their choice.

Omnichannel banking lets customers seamlessly switch between platforms members can self-service themselves without having to repeat each step.

While omnichannel banking that is enabled by technology could help to eliminate some of the obstacles during the customer journey banks (FIs) must be aware to stay on top of the human aspect of banking in the middle of the experience of retail.

Many people would prefer their banks and credit unions to be an actual physical location regardless of whether they don’t often use branches are a source of trust and act as an intermediary for more complex financial transactions.

For instance, individuals of all ages prefer to start new accounts or discuss mortgage options with a person, even if they’ll go through this process via the web.

In order to establish and sustain solid, long-lasting relationships with members and customers of credit unions and banks, they must construct physical elements into their omnichannel efforts.

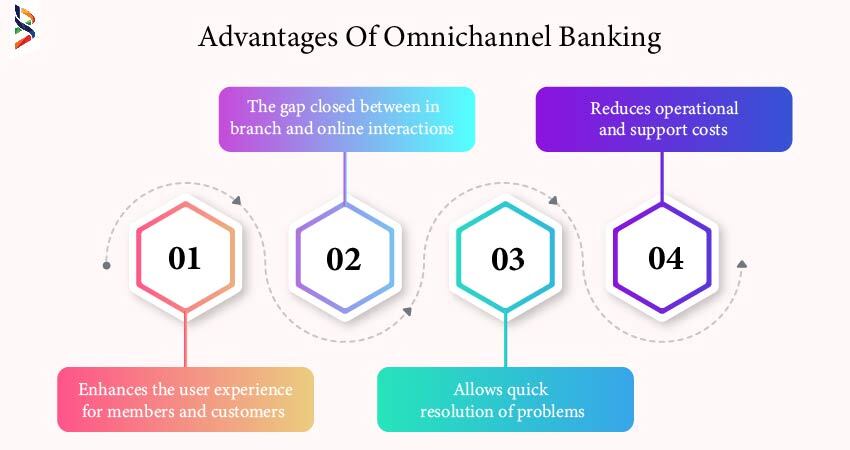

Advantages of Omnichannel Banking

Although full system integration may appear like a huge task for certain FIs and banks, omnichannel banking can provide numerous benefits that go beyond time savings.

Omnichannel banking:

- Enhances the user experience for members and customers.

- The gap closed between in-branch and online interactions.

- Allows quick resolution of problems.

- Reduces operational and support costs.

- Improves satisfaction of members and customers.

- Improves the user experience for members and customers.

- Attracts new members and customers by utilizing a digital-first strategy.

It was once where you could visit the branch of your bank or talk with an individual loan broker for each transaction.

In the last 2 years, this has changed.

Omnichannel Banking Trends in 2023

The world has been turned upside down.

But is it going to stay the same way?

In this article, we will look at how recent trends that are taking place in the world of financial services will impact how customers engage through 2023 and beyond.

1. Many consumers are planning to quit their banks to stay as their clients’ Primary Financial Institutions (PFI) Banks must be a part of their lives the growth of Open Banking represents one of the greatest challenges facing Financial Institutions (FIs).

It offers greater flexibility to users by making it easier to access data. Customer is now less loyal than they ever have been.

They are able to quickly transfer account information, and payment instructions and even switch bank accounts.

They may even change banks to other banks, and offer services that meet their particular needs by pressing the button.

Net promoter scores (NPS) for the field of financial services, which can be a method of ensuring the loyalty of customers, are lower than other industries with an average for the industry of the 0-10s, in accordance with Forrester.

This is a bad sign because the effectiveness of the customer service channels is measured by their performance satisfaction of customers, loyalty, and ultimately, revenue.

This is why FIs are required to develop ecosystems and apps which can provide extensive services to their PFI customers.

The Banking as a Platform model lets banks securely expose their platform to developers and fintech through open APIs. Third-party that is trusted.

Third parties are able to access and build upon existing FSI platforms, and FIs can extend their services through third-party providers and provide these services available to the public access to customers via their available to customers through their Apps and channels.

It’s about being an integral part of their customers’ lives instead of just being an online retailer banking app for banking.

2. Banks have to become more adept in providing personalized customer service and combining the best of both in-person and online interactions.

Financial institutions that have a large branch network are finding that customers prefer digital tools to connect with their banks, versus face-to-face transactions used to be the norm.

Self-service digital banking has experienced an increase in popularity, and consumers are reportedly enjoying it.

However, they are now more aware than ever of their financial status and are looking for expert advice, rather than selling products.

They’d love to talk with an experienced advisor via video calls or in person in the branch, particularly when planning for major life events or taking complex or making difficult (such as buying an automobile or a home or setting up a pension program).

What consumers expect from banks in the present is a seamless, channel-agnostic experience that combines self-service or assisted assistance.

Whatever channel they select, they would like to have the same user experience and the same features and functions similar to those offered in the branch.

To satisfy their financial demands, some always need to talk to an individual, regardless of how technologically advanced. But, they don’t wish to

You must wait in a line in a contact center to wait for up to 20 mins or for an hour to get this.

They want to share their story just once. When customers have a question or raise a complaint in the channel they prefer They don’t wish to respond.

Customers expect faster service and a more enjoyable overall experience

And they are looking for it today in the current, increasingly digital market customers expect companies to be able to adapt and offer the kind of experiences.

Financial institutions can provide the human element to enhance and personalize their digital experience by providing interaction in real-time through technologies like specific direct connect buttons videos or front-end chat.

3. A proactive outbound approach to customer engagement could play an important role for banks in meeting the expectations of the customer.

If your customers do not want to go to the branch or do not have the time or energy to visit your branch, you can provide your customers with the ease of technology with the help of human touch that is friendly and comforting.

Simple solutions, such as automated outbound communication strategies as well as automated support procedures will go a long way in improving your outbound customer interaction.

Outbound communication is not just limited to conversations on the phone in today’s digital world.

There are more opportunities than ever before for outbound engagement, connecting with your customers with them in a meaningful, relevant way through videos, chat experiences direct connection, and even doorstep banking.

This is certainly a major financial services industry trend that is expected to be well-known in 2023, for consumers, as well as banks.

4. Banks will have to be able to handle longer-running transactions or more complex transactions through digital channels.

One of the major issues is that there are simply too many types of service requests within a bank, and a lot of banks’ digital channels are unable to handle the variety of request types.

A typical bank will have approximately 600 different types of service requests that they can handle in a branch environment, however, digital channels are able to serve only 25-30% of these Service requests currently being handled offline and require to be made available online.

If consumers are beginning to view digital channels as standard options rather than alternative ways of customer service, they’ll expect.

Support for more complicated transactions will be made available by default via banks’ mobile apps and online. This will be among the most challenging issues that will be facing in 2023: banks.

To accomplish this, Brisk Logic offers solutions that let financial institutions run lengthy processes, such as buying insurance plans or making the loan digital channels that are self-service and are managed through Dynamics 365 workflows.

They are now the mainstay services that a customer might want from the bank.

5. In the future, the multichannel world will include the ability to make payments in a variety of ways, with instant origination and instant payouts

“Buy Now Pay Later” plans have been increasingly sought-after for customers. The financial institutions have been working with merchants and retailers to compose new payment strategies. In order to compete, banks require omnichannel Omni-product origination to offer loans “in every way or other places.”

This is a requirement of having a long-lasting connection with the customer in order to provide a seamless and hassle-free experience from the beginning to the point.

Therefore customers can enjoy greater flexibility with their purchases. They can make installment payments with ease, avoid regular ID checks and Make a credit card application online with their credit card.

They will receive a response within minutes which results in improved transactions, which means immediately collecting loan request information from every origination channel to provide a rapid response.

This is achievable through a high degree of integration with CRM, origination channels, and origination.

Conclusion:

Banking through many channels is becoming more popular overall.

Even though banks and credit unions have a history of being slow to adopt new technologies and fashions, more financial institutions (FIs) are starting to see the financial benefits of omnichannel capabilities, including cost savings and increased member/customer satisfaction.

Due to the fact that more users than ever are performing routine transactions online, financial institutions (FIs) are shrinking their physical footprint and modifying their branch locations to cater to customers’ more complex banking needs and products, like financial planning and loans.

Additionally, branches are changing to better meet the needs of local micro-markets and demographics; frequently, this involves adopting more modern technologies like virtual teller pods, video conferencing services, and interactive teller machines.

Contact the Brisk Logic team right away for more advice on developing into a true omnichannel institution. Let’s discuss how to make your space welcoming to the banking of the future.

FEEL FREE TO DROP US A LINE.